By Matt Towery, InsiderAdvantage

Years ago, as a syndicated columnist, I used to opine on yet to materialize, events in politics or the economy. I’m sure my misses have escaped my memory bank, but predictions such as my column of 2007 basically saying “get out of the financial markets” and my “Why Donald Trump Could Win “piece in 2015 are, naturally, the ones I remember. Of course, Wikipedia, has changed that into my having urged Trump to run. While Trump did tweet the column out, I feel quite certain my one small voice had nothing to do with this decision.

So now this same one small voice has another observation that I see unfolding day-by-day and which h is speeding towards a very specific date, April 30th to be exact.

Let me explain.

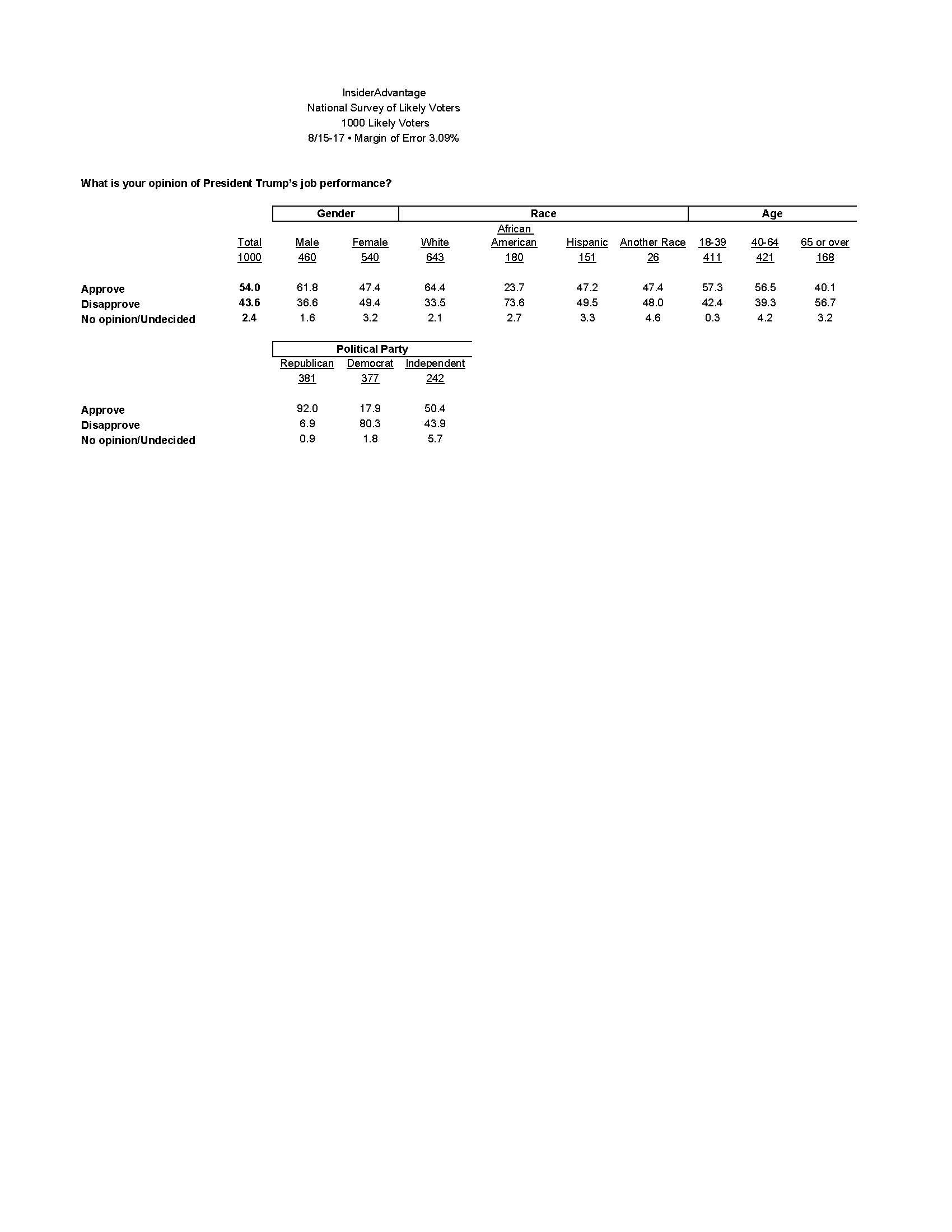

Almost every week since he was sworn in, I’ve appeared on one of the Fox News Channel evening programs and have asserted that Trump’s presidential approval ratings should be divided as an average amongst the pollsters who proved they could accurately poll Trump in his three presidential elections, and those who could not. For example, over the two-week period prior to Easter, pollsters in the RealClearPolitics average who gauged Trump’s approval rating showed the difference between the president’s approve/disapprove job performance with a negligible half a percentage point-to one percent gap. But the pollsters who were less accurate in those cycles, showed Trump down by between a seven-to-eight percentage gap.

I left Gallup’s recent result out of those averages. Despite being the once gold standard for presidential approval ratings, they stopped their daily tracking of that rating some time ago and are not really battle tested as to polling Trump in election year swings states.

And while even many media digital sites frequented by Republicans highlighted polls such as Quinnipiac’s twelve point to the negative approval rating for Trump over that time, I continued to argue that Trump’s real approval rating remained robust and certainly nowhere near the dreadfully low levels reached by his predecessor. In other words, in an incredibly polarized world and while taking a legacy media beating over tariffs, Donald Trump’s approval ratings have been fine.

But, as my colleague Robert Cahaly of Trafalgar Group and I have been warning, the media and polling mafia that are waiting to create a “he is doomed” scenario, have been frustrated by public support in the polls of Trump’s actions related to illegal immigrants and his ability to blunt financial market meltdowns over tariffs with deft “pauses” and “negotiations.”

Their latest themes aimed at Trump have been to use the word “chaos” in unison to describe his first few months back in office and to revive the tired old “resistance” theme from his last term.

None of this is working. But there is one looming matter, one potential “inflexion point” mostly not of his making, that I believe could be used to try to make those allegedly “bad” approval ratings a reality, rather than a myth. The Trump White House, which has been amazing in its ability to get ahead of, or quickly deal with, the firehose of negative stories the media constantly shoots out. Only Trump’s battle with Fed Chair Powell, which started impacting the financial markets after the Easter weekend wrapped up, started chatter on financial news networks and among analysts of a potential looming recession. But it was just chatter. The legacy media and Democrats have been searching, thus far to no avail, for the “aha” moment.

April 30th could be a day that the media and Democrats have been waiting for, a true inflection point. On that day the Commerce Department will announce the first quarter GDP number. And almost nobody has been talking about it. It has the potential to become an explosive and determinative issue. Here is why.

Until recently, the “consensus” among those who forecast our national GDP was for a quarterly report of perhaps growth of perhaps one and a half to two percent. But quite some time ago the Atlanta Federal Reserves “GDP Now” forecast, which has over the years been the most accurate at predicting the GDP, started moving towards a potential negative number. I discussed the Atlanta Fed’s unique forecasting model in my book of several years ago, Newsvesting (if interested, see the link at the conclusion of this article) As of the end of the Easter Weekend, they were projecting a negative growth rate of two percent or more.

This has been underreported for a reason. The shock effect of a “surprise” downturn to the negative would be heralded as the start of a true recession. And such a disparity between the “consensus” and the actual result would immediately be interpreted as a direct result of President Trump’s moves related to tariffs.

Pure logic would reject that reasoning, in that the first quarter ended before Trump declared his “Liberation Day” and provided details concerning the various tariffs to be imposed. What is even more puzzling is that the Atlanta Fed’s forecast for the first quarter GDP began to plummet after Trump’s tariff announcement. How does a post-quarter policy affect a closed-out period? But I see no sense in questioning the “GDP Now” methodology, primarily because its results have traditionally been much more accurate than others. I can’t rely on those of us would have a proven track record of polling Trump and then dismiss a forecasting model that has been equally successful in predicting the gross national product.

In reality, most of the first quarter GDP for a new administration, is on the policies of the prior one. However, that will be lost in translation as a media, hungry to drive Trump’s approval ratings down, will use the words Democrat strategists have tested, such as “chaotic” to describe Trump’s economic strategy. If indeed the Atlanta Fed is correct, or even close to being on target, the word “recession” will dominate the headlines. The current focus of illegal immigrants with questionable pasts, being swept up in the deportation of illegal immigrants with significant criminal records, will disappear. That storyline is not only not damaging President Trump’s approval ratings, but in fact begin to bolster them.

But planting the idea with an unprepared public that the nation is plunging into a deep recession is something entirely different. Trump’s administration would be well advised to inoculate themselves now by focusing on the upcoming first quarter GDP report right now. They must penetrate to the average voter that the tariffs were not revealed until the after the quarter ended. They must explain why the policies of the Biden administration impacted the first two and a half months of the new administration’s term.

Of course, it is possible that the actual GDP number will come in better than the Atlanta Fed’s forecast is projecting. But if their forecast is correct, we can expect to see the pollsters who consistently fail to poll Trump’s strengths, race to amplify his perceived weaknesses. With less than two weeks to go, the guessing will be over.

Matt Towery has authored numerous books. Among them is Newsvesting: Use News and Opinion to Grow Your Personal Wealth. Here is the link: